TIME magazine recently put out a cover story claiming that each American owes a $42,998.12 slice of our $13.9 trillion national debt. What is old is new again, apparently. Ross Perot must be sighing in forgotten silence, somewhere.

The author, James Grant, puts out Grant’s Interest Rate Review twice a month, and has done so since 1983. On top of that, he’s written some books–most of them about money and finance, and a couple about pet political topics.

I was unfamiliar with him before the TIME article which bears his name, and which the editors of that magazine bafflingly found worthy of the cover.

Based solely on his article, I would say he is perhaps not a reliable source on economic matters. He has no economic credentials at all, although having some wouldn’t necessarily make his arguments less vapid.

He goes on for a while about the history of money and the nature of debt, does a little goldbugging, makes some shockingly fallacious assumptions and comparisons (cutely noting that the Department of the Treasury should rightly be called the Department of the Debt), and then concludes with this stunning suggestion:

We need to stop the squandermania. How? By resuming the principled fight that Vivien Kellems waged against the IRS during the Truman Administration. It enraged Kellems, a doughty Connecticut entrepreneur, that she was forced to withhold federal taxes from her employees’ wages. She called it involuntary servitude, and she itched to make her constitutional argument in court. She never got that chance, but she published her plan for a peaceful revolution. She asked her readers–I ask mine–to really examine the stub of their paycheck. Observe how much your employer pays you and how much less you take home. Notice the dollars withheld for Medicare, Social Security and so forth. If you are like most of us, you stopped looking long ago. You don’t miss the income that you never get to touch. Picking up where Kellems left off, I propose a slight alteration in payday policy. Let each wage-earning citizen hold the whole of his or her untaxed earnings–actually touch them. Then let the government pluck its taxes. “Such a payroll policy,” wrote Kellems in her memoir, Taxes, Toil and Trouble, “is entirely legal and if it were universally adopted, in six months we would have either a tax revolution or a startling contraction of the budget!”

This suggestion makes precisely zero sense, unless the intention is to balloon the debt even further until it truly becomes unsustainable. Plenty of Americans, given the chance, wouldn’t pay any federal taxes at all–self-centeredness is, for better or worse, one of our prized cultural traits. As it is, about 12 million Americans don’t file their taxes by the April 15th deadline. Perhaps Grant’s scheme is exactly what it seems like: to cut the government off at the knees, make it unable to pay its debts except by accumulating much more debt, and thereby collapse the whole system. It’s a scheme worthy of a comic book supervillain, I suppose.

This is a good opportunity to talk about what sovereign debt actually is and means. Grant dismisses the idea that a government isn’t like a household, but it happens to be true. In addition to the sheer scale of a national government, it also has one power that a household never does: the power to levy taxes to raise money. On the other hand, government debt does work a bit like personal debt, in the sense that both a government and an individual have credit ratings which reflect outside confidence that debts will be repaid. Poor credit ratings leave a government (or individual) with progressively worse options–payday loans and other high-interest, low-utility vehicles for individuals, and similarly unpleasant (and unsustainable) loans are available for governments which are poor credit risks. The International Monetary Fund specializes in such loans, and they usually come with stipulations that are difficult to uphold and often require that citizens’ needs be thrown by the wayside in favor of repaying debts.

The US is nowhere near needing that kind of help, though. Grant mentions our current interest rate on new debt, which is about 1.8%. This is incredibly low. It signifies that American debt is still considered a safe place to sock away one’s wealth–in other words, it means investors are very confident that the US government is not going to implode anytime soon. This is a pretty safe bet, even with our current absurd political antics.

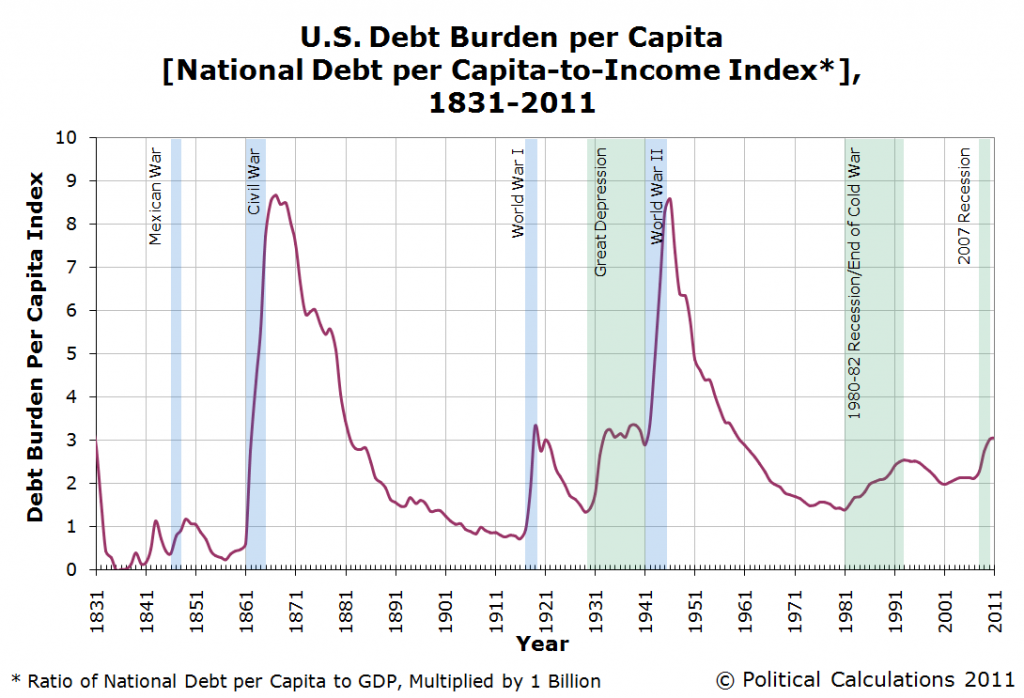

Even putting aside whether we’re good for our debts, are we actually spending at unsustainable levels? This is an instance where I think a picture tells the story better than words can, so I’ve borrowed a graph from Townhall Finance:

Other graphs try to muddy the waters, by showing debt per capita with retroactive inflation adjustments. Debt per capita vs. gross domestic product is a better measure, because GDP is ultimately how the debt is going to get paid down. Higher GDP means government spending can be cut (there’s less need for the government to step in when the economy is doing well) and it also means tax receipts will be higher due to higher incomes. As an aside, this is why income and wealth inequality are destabilizing forces: they narrow the tax base, which makes concentrated resistance to taxation more effective, i.e. it’s easier for one billionaire to shelter his fortune than for 10,000 families to avoid paying taxes on the same amount spread between them. Grant’s proposal makes no mention of this, of course, because it’s somehow more urgent that we get back to a gold standard. I’m just as confused as you are.

I will close with some of the more amusing comments from the peanut gallery regarding Grant’s moment in the limelight.

Grant's preferred policy course, a barely coherent combination of a flat tax and massive spending cuts, is especially dubious, and gives one the impression that maybe his debt fearmongering is just pretext for his archconservative preferences about government.

So there's no reason to cut the debt today, and no reason to cut the government down to a pre-New Deal size. At least not any economic reasons. And that's why the best Grant can do is try to scare people by pointing out that our debt is in the trillions — did you know that's a million millions?!? — without mentioning that our economy is in the trillions, too.

Was Time purchased by Zero Hedge when I wasn’t looking? Who thought this was a great way to make the magazine relevant and credible right now?

[Matt Yglesias](http://www.vox.com/2016/4/14/11430450/time-magazine-debt) draws my attention to this week's cover of_Time_, a Trump-friendly warning that we're all doomed thanks to the national debt. Matt takes apart this inane argument just fine, but I'll do it more quickly: You will never have to pay down this debt. Nor will your children. Or your grandchildren. Just forget about it.

TIME may not be a bastion of hard-hitting journalism, but I would’ve hoped their standards were somewhere above the _National Review. _Someone no doubt thought this would sell. As for me, I’m tempted to cancel my free subscription several months early, as my conscience has a hard time reconciling whatever poor trees had to perish to deliver such pap onto my coffee table.